MAY 2024 – VALUE OF VANADIUM: INSIGHTS FROM VR8

| Dear Partners, Colleagues and Associates, For investors of Vanadium Resources Limited (ASX:VR8,DAX:TR3), these are very exciting times. In 2022, global demand for vanadium pentoxide (otherwise referred to as V2O5) was ~200,000 tonnes (of V2O5 equivalent). Thanks to the projected market growth driven by steel demand for property development in Asian markets, the aviation sector, and innovation in energy storage, demand for vanadium pentoxide will experience a step-change in its growth trajectory, reaching ~300,000 tonnes by 2033. It gets even better when factoring in the conditions that guide global supply. High-quality primary sources of vanadium are globally scarce, especially outside of China and Russia, which control nearly 80% of global production. Not only does VR8 have one of the largest and highest-grade vanadium resources in the world, but it is also ideally situated within the renowned Bushveld Complex in South Africa, placing it firmly in the box seat for near-term development and production. At full production, VR8 is on track to produce 11ktpa of vanadium pentoxide from its phase 1 project, which will equate to 3.7% of global demand in 2033. As we said: very exciting times. We would like to get you excited about the prospects of vanadium too. So, for the remainder of 2024, we will be sharing a series of newsletters with enlightening facts about vanadium, the market opportunities and its demand drivers, and how VR8 is preparing to help meet this future demand. |

Vanadium, a chemical element, is a hard, silvery-grey, malleable transition metal. The elemental metal is seldom found in nature, making it both rare and valuable. Once isolated (which can be done artificially), the formation of an oxide layer stabilises the free metal against further oxidisation, making it strong and durable.

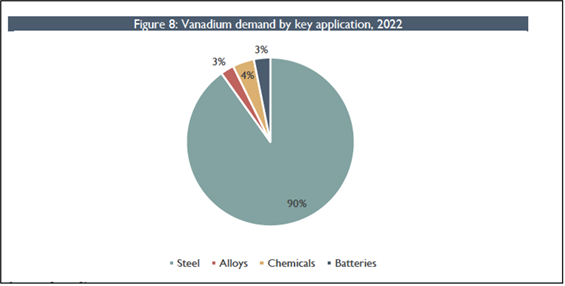

STEEL: Approximately 90% of vanadium produced is used as a steel additive. Thanks to its strength, vanadium-steel alloys are used for the manufacturing of tools, armour plates, vehicle axles and girders in construction. Other end-use markets include aerospace, automotive, construction (bridges and large buildings), and oil and gas pipelines.

BATTERIES: The global drive toward reliable, renewable energy solutions and the reduction of greenhouse gas emissions have brought about a rapidly growing demand for battery energy storage. Vanadium flow batteries (VFBs), which utilise vanadium to store and manage large amounts of energy, have the potential to fill this need and play a larger role in the global energy transition.

The advantages of VFBs relative to other battery technologies, such as lithium-ion batteries, are being increasingly recognised. Firstly, VFBs are highly scalable, as their capacity can be expanded with the simple addition of electrolyte tanks and stacks. In addition, they can withstand being charged and repeatedly discharged over extended periods without inducing battery damage, while their use of non-flammable vanadium electrolyte enhances their safety. VFBs also have a long life cycle, making them best suited for utility and grid-scale applications, such as the storage of wind and solar energy. Finally, the vanadium from VFBs is straight forward to recycle, enhancing their overall sustainability characteristics.

OTHER: non-metallurgical applications of vanadium include ceramics, catalysts, dyes and electronics.

Source: Project Blue, Largo PhysicalVanadium, December 2022

Scientific Vanadium

Symbol: V

Atomic Number: 23

Electron Configuration: : [Ar] 3d³4s²

Atomic Mass: 50.9415 u

Melting Point: 1,910 °C

Boiling Points: 3,407 °C Discoverer: Andrés Manuel del Río

Supply, demand, and the role South Africa plays

China is the largest producer of vanadium and has been growing its market share to account for 55% of global output in 2022. Russia is the second-largest vanadium producing country, where most of the output is attributed to EVRAZ, a vertically integrated steel, mining and vanadium business. South Africa is the third-largest producer. Within South Africa, supply comes from two major players, Glencore and Bushveld Minerals, which both have existing mines within the Bushveld Complex that are in proximity to VR8.

South Africa’s VFB supply chain currently involves raw material output, electrolyte production, and a locally manufactured balance of plant components. However, there is potential for the country to play a more significant role in the value add-chain.

For the domestic VFB industry to grow, it is crucial to implement measures that support and drive both vanadium demand and supply.

South Africa is facing an electricity crisis due to underinvestment in its electrical generation and transmission infrastructure. The increasing demand for electrification in South Africa creates an opportunity for VFBs to enhance energy supply through renewable energy sources. In addition, developing a South African VFB industry becomes crucial to effectively supply the region with battery energy storage systems and play an essential role in supporting broader electrification initiatives on the continent.

VR8 are proud to be playing a key role in the energy transformation within South Africa. Not only will VR8 produce the vanadium critical for manufacturing VFBs, but it is also expected to construct and utilise solar power and VFBs at both of its planned operations.

VR8’s preparedness for future demand

VR8 strives to become a world-class producer of vanadium pentoxide and is on track to achieve this ambition. VR8’s operations are ideally located within South Africa’s renowned Bushveld Complex and are surrounded by approximately thirty-five mining and smelting operations, giving it access to an abundance of infrastructure, contractors, engineers and local expertise.

Steelpoortdrift Vanadium Project (‘Steelpoortdrift’): Steelpoortdrift boasts a substantial vanadium deposit that will last for generations to come with a Mineral Resource of 680 million tons at an average in-situ grade of 0.70% vanadium pentoxide (V2O5).This is large enough to support a mine life of over 180 years at the proposed mining rates. VR8 intends to mine the ore and process it through a concentrator plant at the Steepoortdrift mine-site to produce a vanadium-rich concentrate.

Tweefontein Project (‘Tweefontein’): From Steelpoortdrift, the vanadium-rich concentrate will be transported to Tweefontein where it will be processed through a Salt Roast Leach plant to produce an initial average 11ktpa tons a year of V2O5 flake for the steel and VFB markets. VR8 has identified the potential opportunity to utilise a rope conveyor system between the concentrator and the SRL, which will further enhance the project’s profitability and environmental characteristics.

VR8’s immediate goal is to develop an initial mine, concentrator and Salt Roast Leach processing operations to produce vanadium pentoxide which will be sold into the steel and battery energy storage sectors. VR8 then aims to expand its operations to produce a range of other products such as ferro vanadium, vanadium nitride, vanadium electrolyte, and other related products.

VR8 has ambitions of becoming self-sustaining and removing dependency on traditional power resources. They intend to investigate the potential building of renewable solar power generation coupled with battery energy storage facilities at each of their sites. Ultimately, VR8’s long-term strategic vision is to become a vertically integrated operation across the entire spectrum from mining and processing of vanadium, to battery manufacturing and renewable energy generation and storage.

Vanadium offtake MOU announcement

In April 2024, VR8 entered a memorandum of understanding (MOU) with China-based Panjin Hexian Materials Technology (Hexian) for the purchase of 4ktpa tonnes a year of V2O5.

Hexiang, one of China’s largest vanadium nitride producers, signed the offtake deal for an initial 5-year term with an option to extend the term.

The MOU represents approximately 37% of VR8’s planned V2O5 production in phase 1 and underlines the continued demand for vanadium products in the mainland China market. The MOU represents a step in the overarching funding strategy that has been implemented by VR8 for its vanadium projects, and it remains in discussions with multiple potential offtake partners, strategic equity investors and debt financiers.

MOU signed with major VFB producer

On 30 April 2024, VR8 announced that they have entered into a Memorandum of Understanding (“MOU”) with Enerflow Technology, a subsidiary of Tian’en Energy.

Tian’en Energy is the provider of a comprehensive range of services, including the construction and operation of power stations, for the photovoltaic, wind power, gas power generation and cogeneration sectors.

For VR8, the MOU represents a source of vanadium demand from the growing global energy storage market including VFBs, which comes in addition to the continuing demand for vanadium from the steel & alloy market.

Together, the MOUs of Hexiang and Enerflow represent 8ktpa (or ~73%) of the planned 11ktpa V2O5 production planned for Steelpoortdrift’s Phase 1 operations, and highlights the continuing strong demand from China for reliable sources of vanadium supply.

Thank you for taking the time to read VR8’s newsletter on the value of vanadium. Our next newsletter will be in your inbox in June 2024. For more information about VR8, please visit our website.