Dear Partners, Colleagues and Associates,

This is the second in a series of newsletters filled with insights about vanadium, its market drivers, and the potential of Vanadium Flow Batteries (VFBs).

With the ongoing shift away from fossil fuels and the expansion of the renewable energy industry, the need for efficient and scalable energy storage systems has also grown. The VFB market size is expected to grow from USD 289 Million in 2023 to a staggering USD 805 Million by 2028 [Source]. VR8 is striving to become a globally significant producer of vanadium pentoxide to service this growing market. Continue reading to understand more about the key market drivers in the vanadium sector, and how VR8 is advancing its world-class Steelpoortdrift Vanadium Project.

Shifts toward seeking alternative energy storage solutions

Energy is central to the global climate crisis, with fossil fuels contributing over 75% to greenhouse gas emissions. It is imperative that the world seeks alternative energy solutions.

In 2015, The United Nations General Assembly established 17 Sustainable Development Goals. Sustainable Development Goal 7 aims to “Ensure access to affordable, reliable, sustainable and modern energy for all,” and prioritises sourcing viable energy solutions. Governments across the world are striving to transition toward alternative and renewable energy storage solutions to achieve net zero carbon emissions. VFBs are expected to play a crucial role in achieving this goal. The long-duration capabilities of these batteries, coupled with their low environmental impact and recyclability, present a solution for a sustainable energy future.

Market Opportunities and Enablers

The rising global demand for renewable energy is driving the need for reliable storage solutions like VFBs. As a result, supportive government policies and incentives for energy storage projects are boosting market growth.

It has also been widely recognised that a key advantage of VFBs is the flexibility and scalability of the technology, allowing it to fill several needs of the storage market. Continuous advancement in technology is improving efficiency and reducing costs.

Technology Considerations

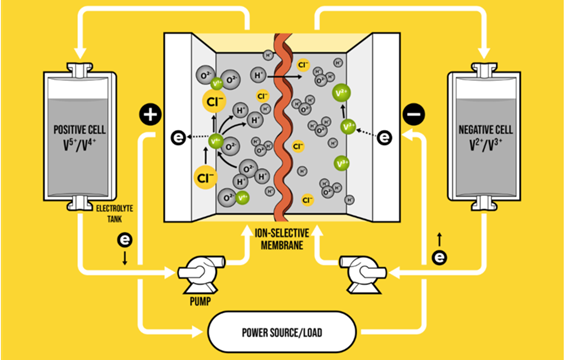

There are several advantages to VFBs compared to other storage technologies. By design, VFBs are flexible and expandable because they can be designed with decoupled power output and energy capacity with long discharge durations.

Increasing the capacity for energy storage is simply a matter of adding more electrolytes without needing to expand the core system components. This enables the VFB system to maintain its levelised cost per kilowatt-hour delivered throughout its lifetime, a capability that Li-ion battery systems cannot achieve. VRBs were developed in the 1980s. The technology has since evolved to include sub-chemistries and design variations. Decades of research, development and testing have resulted in the latest model, which uses electrolyte solutions with vanadium ions in four different oxidisation states to carry charge.

While VFB technology offers significant advantages, it does have some limitations. The technology is heavy, meaning that VFB energy and power densities are relatively low, necessitating larger and bulkier systems. Further, the installation environment must accommodate electrolyte tanks and pumping systems.

Durability, recyclability and safety of Vanadium Flow Batteries

Durability: The flexibility of the technology gives VFB a distinct advantage over Li-ion batteries which are known for their short lifespan and energy capacity degradation. Li-ion batteries are not designed to sit idle for extended periods or discharge completely. By comparison, VFBs do not experience capacity degradation with each discharge cycle leading to longer battery lifetimes. This means that VFBs could discharge multiple times for various durations without affecting the longevity of the system.

Safety: Li-ion batteries are notorious for overheating and thermal runaway. In June 2019, the South Korean Ministry of Trade, released findings from an investigation into 21 ESS fires that occurred in the country between May 2018 and January 2019. According to the report, insufficient battery protection against electric shock, inadequate management of the operating environment, faulty installations, and insufficient integrated protection and management systems were the predominant hazard causes.

In contrast, VFBs require minimal thermal management and therefore do not present a fire risk. Furthermore, most flow battery chemistries use aqueous electrolytes, which are largely composed of water and are inherently non-flammable despite containing acid additives.

Recyclability: Arguably the most attractive benefit of VFB energy storage systems is their indefinite reusability, which reduces waste and the need for new materials.

The liquid electrolyte used in VFBs can be almost completely recovered and reused in another battery application, with minimal processing steps and cost. Spent electrolytes can also be recycled into commodity-grade vanadium products, including vanadium pentoxide (V2O5), which can be used in various other applications.

Benefit for South African economy and production

South Africa’s vanadium industry has the potential to play a major role in the global transition away from fossil fuels and towards renewable energy generation and storage.

South Africa is the largest primary producer of vanadium, and the third-largest overall producer. This is because South Africa produces vanadium as a primary objective, not because of the production of steel. The reason for South Africa’s large vanadium production is because the Bushveld Complex, where VR8’s flagship Steelpoortdrift Project is based, is one of the largest and highest-grade vanadium endowments on the planet.

By shifting focus to include the production of vanadium for the use in VFB manufacturing, South Africa can support the development of a home-grown renewable energy generation and storage industry. This shift is relevant for the global markets and addresses the local need for a reliable power supply.

There is an economic case to be made for the development of battery manufacturing facilities in South Africa, which will reduce the cost of transportation and shipping of vanadium from South Africa to global manufacturers. This will lower production costs when compared to other manufacturing facilities. By investing in manufacturing facilities, South Africa has the potential to become a major exporter and world leader of VFBs.

What this means for VR8

VR8 is aiming to become a globally significant vanadium producer through the development of its world-class Steelpoortdrift Vanadium Project. Given the projected outlook for vanadium demand over the years to come, VR8 believes it is in a strong position to advance Steelpoortdrift through to production. VR8 is currently running a competitive process to seek offtake agreements for Steelpoortdrift, which may include additional features such as EPC and financing.

Strategic equity and offtake progress to date

As a result of VR8’s ongoing competitive process, VR8 entered into three offtake MOUs during April and May 2024. These offtake MOUs were with Panjin Hexiang New Materials Technology Co. Ltd. (‘Hexiang’),Enerflow Technology Co. Ltd (‘Enerflow’), and Zhongxin New Materials Technology Co.,Ltd. (‘Zhongxin’). Each of these MOUs detailed the supply of 4ktpa of vanadium pentoxide (V2O5) over a 5-year period, with an option for the customer to extend by a further 5 years. In total, these MOUs represent over 100% of VR8’s planned production of ~11ktpa under Phase 1.

Further to the interest the Company has received under its existing offtake MOUs, VR8 is continuing discussions with a range of other parties across China, Japan, Korea, North America and Europe in relation to potential offtake, strategic equity interest, EPC and financing.

VR8 believes that the ongoing competitive process it has deployed will lead to securing the most favourable terms for the development of the Steelpoordrift Project, ultimately maximising the Project’s NPV for existing shareholders.

The value of vanadium in shaping a greener economy A picture (or a video) is worth a thousand words. Below is a powerful summary on the role vanadium and VFBs play in shaping a greener global future. Click image to watch.

Conclusion

Thank you for taking the time to read the latest newsletter from VR8 on the value of Vanadium. Should you wish to read earlier editions, please click here.

Please visit our website.

Information Sources:

Guidehouse Insights, Vanadium RedoxFlow Batteries: Identifying Market Opportunities and Enablers·